Is the “Uber Effect” going to be as large as the “Facebook Effect”?

If IPOs do come to fruition and there are some newly minted millionaires, Bay Area housing markets could have another renaissance.

Uber (and/or Lyft), Airbnb, Pinterest, and Slack are believed to be going public in 2019

- Combined, the four potential 2019 IPOs could reach valuation of $176 billion, almost twice as large as Facebook’s 2012 valuation

- 10,000 San Francisco based workers could be affected, which could have a notable impact on the Bay Area housing market

- Nevertheless, a company going public does not necessarily guarantee wealth for all of its employees

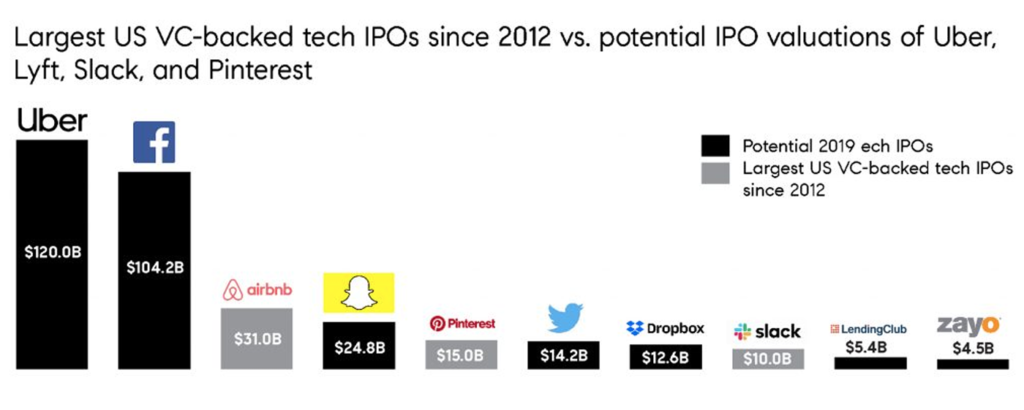

Bay Area housing market dynamics may be changing once again as a result of potentially large tech IPOs on the horizon. With Uber (and/or Lyft), Airbnb, Pinterest, and Slack all believed to be going public in 2019, their rumored IPO valuations would all rank among the 10 largest venture-backed IPOs since 2012, according to CBInsights and Figure 1. In fact, if Uber alone stands to its valuation at $120 billion, it would be bigger than Facebook’s $104.2 billion valuation in 2012. Combined, the four potential 2019 IPOs could reach valuation of $176 billion, almost twice as large as Facebook’s 2012 valuation.

However, even more importantly for the Bay Area, the headquarters of all four IPOs are in San Francisco. And, with Uber and Airbnb being among the largest employers in San Francisco, combined workforce of the four companies that could be affected by IPOs adds up to about 10,000 workers.

it is important to note that going public for companies in general does not necessarily guarantee wealth for all of its employees. Many factors govern how much money an employee makes from an IPO, including their tenure with a company, how many stock options or restricted stock units they received, when they can exercise their options and ultimately when they decide to sell. Also, different options have different stroke prices pegged to the company’s private market valuation at the time they joined. And, as noted above, employees are subject to an IPO lock-up period, which is a contractual restriction preventing insiders who acquired shares of a company’s stock before it went public from selling the stock for a stated period of time after it goes public, typically from 90 to 180 days after the date of the IPO. Importantly too, restricted stock units may be taxed at ordinary income rates, which can exceed 39 percent at the federal level, plus the applicable state taxes.

Also, current housing market conditions are notably different than prior to the Facebook Effect in 2012. Most specifically, median home prices in the Bay Area now are about 2.2 times higher than they were at the beginning of 2012. And, buyers have already shown significant restraint leading to a jump in price reductions in recent months, as described in our recent analysis. But, if IPOs do come to fruition and there are some newly minted millionaires, Bay Area housing markets could have another renaissance.