Real Estate Myth Busting

Real Estate Myth Busting

San Mateo & Santa Clara County Real EstateReal estate is always a good news story especially here in Silicon Valley where our California real estate, for better or worse, is the envy of the rest of the country. The two current headlines below seem to be dominating real estate news these days:

#1: People are leaving California in droves (Not entirely accurate)

#2: There is a historic lack of inventory on the market this year creating a feeding frenzy (Not entirely accurate)

We (Granoski | Weil & Associates) bring unmatched local real estate knowledge, insight and knowledge about what’s really happening in our unique local market and why. The media has a different set of objectives then we do. Our priority is to provide accurate data and analysis of regional trends so our clients can make well-informed decisions regarding buying and selling real estate. We believe that accurate analysis is profitable. Myths and misleading data will cost you money and opportunity.Lets dive into the truth and clarify these two recent myth’s…Truth #1: People are not fleeing California, but they are relocating within the state.

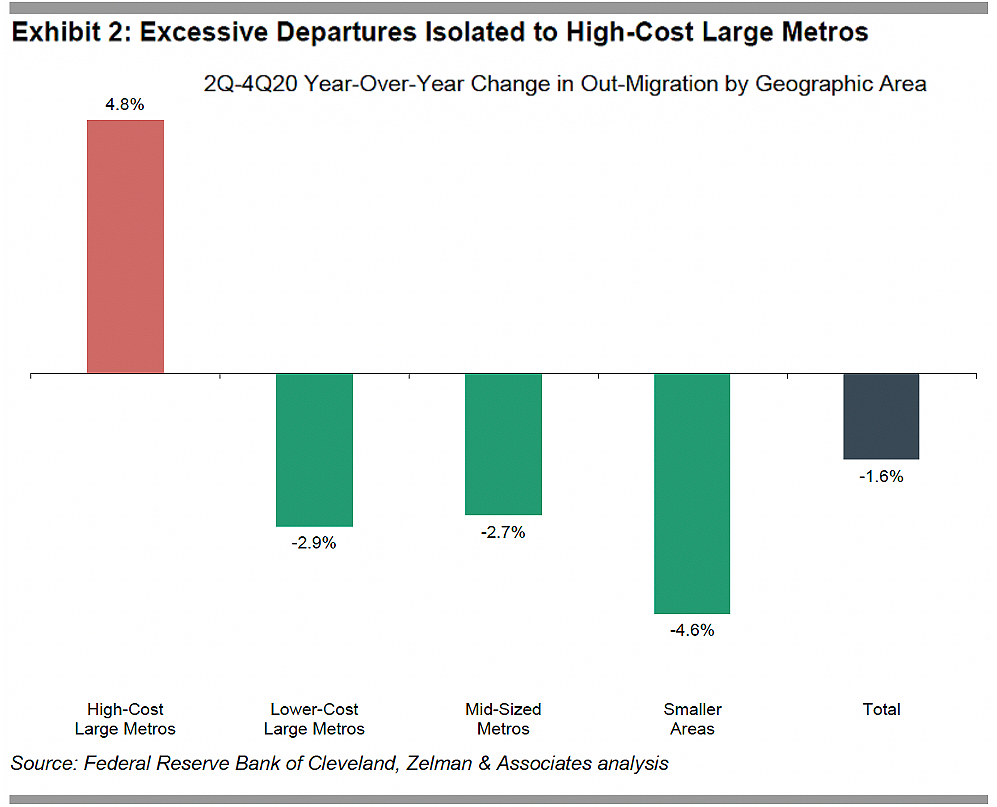

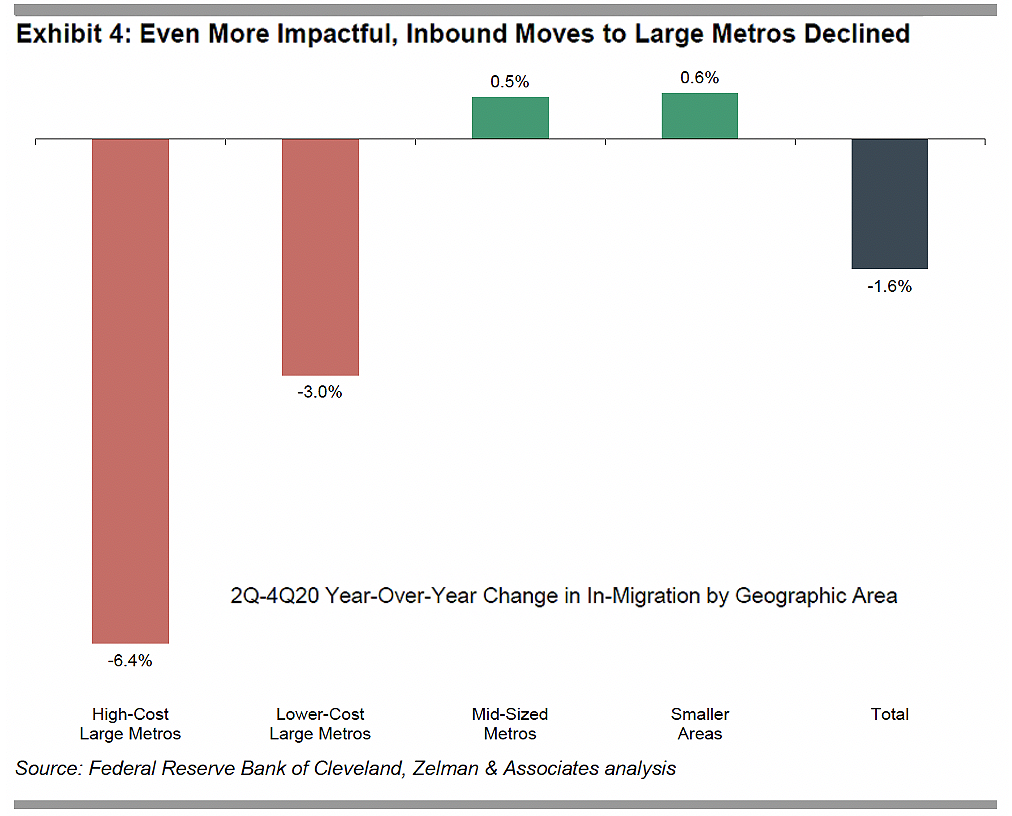

Population flight from high-cost metros: a mountain or a molehill?: Although the media narrative might make it seem like a significant portion of the population picked up and moved to a new part of the country during the pandemic given the freedom of work-from-anywhere policies, our triangulation of several data sets suggests that the dynamic has been exaggerated. Across the country, households moving to an entirely new metro actually declined versus recent norms. Instead, the storyline should almost exclusively focus on San Francisco, New York and Boston, where urban departures and fewer new move-ins were material. But the beneficiaries were not Florida, Texas or Montana – at least not any more than normal—it was the neighboring suburbs. In our opinion, the housing surge is more about upgrading within markets than increased migration across markets.

In our market, we have certainly experienced what you see in the charts below:

- 1. Pressure on pricing in urban, high valued condos and homes and

- 2. high-demand and appreciation in our neighboring suburbs.

As our vaccine numbers reach near peak and with great anticipation, we are seeing a return to urban, high value assets— great news.

Truth #2: Inventory and new listings are not at Historic lows, but demand has substantially increased (mostly due to historic low interest rates)

This first two tables below relate to the supply of homes in the market.

The numbers below (see table 1) represent the total number of houses that were for sale comparing Q1 2020 to Q1 2021. This is the total supply of homes that were available to be purchased. You can see the total number of homes available on the market increased year over year in almost every city on the peninsula.

Table 1

Below (see table 2) are the numbers for the total number of fresh new listings that were brought on market during Q1. Comparing 2020 to 2021 the number of new listings increased dramatically in almost every city. These supply numbers relate directly to seller confidence in the market.

Table 2

The statistic below (see table 3) reflects the amount of demand in the market. The numbers represent the listings that went into contract the first three months of the year. There is a dramatic increase in demand from 2020 to 2021.

Table 3

The conclusions drawn from these statistics is that housing inventory (supply) has increased year over year (debunking media claims to the contrary). The real story is that demand has substantially increased which makes the market feel like there are less listings coming on the market. While there are can be many variables that drive the real estate market, it’s our conclusion that historically low interest rates coupled with optimism about vaccines easing the strain of the pandemic has led to a red hot sellers market during the first quarter of this year.

This may seem like a subtle difference, but our focus is on buyer demand—not lack of inventory. Inventory on the peninsula is always scarce and as shown above it has actually increased year of year in Q1. It’s important to understand the subtleties of our local market so you can make better informed buying and selling decisions.

Our advice:

If you’re BUYING in the current market: waiting for more inventory is not the solution. The solution is to act efficiently to evaluate new homes as they come on the market. If there’s a home you’re interested in, you need to be prepared to move fast and compete with other offers.

If you’re SELLING in the current market: be careful of pricing your home too high in a hot market. It can be tempting to push the limit of your homes worth. A better more savvy decision is to price a bit lower and let the competition of buyers push the upper limit of your homes worth. The only homes that sit in our market are ones that are priced too high.

As always fee free to contact us with any questions and for all of your residential real estate needs.